🗣 SL提问: 博时智选量化多因子股票C

✍️ Ai批改: Overview of 博时智选量化多因子股票C

博时智选量化多因子股票C is a Chinese stock mutual fund offered by Bosera Asset Management, one of the largest and most reputable asset management companies in China、The fund aims to provide long-term capital appreciation by investing in a diversified portfolio of Chinese stocks using a quantitative multi-factor approach.

Investment Objective

The investment objective of 博时智选量化多因子股票C is to outperform the benchmark, China Securities 300 Index (CSI 300), by selecting stocks with attractive valuations and growth potential using a quantitative model.

Investment Strategy

The fund employs a quantitative multi-factor model to select stocks、This model considers various factors such as:

1、Value: The fund looks for undervalued companies with low price-to-earnings (P/E) ratios, low price-to-book (P/B) ratios, and high dividend yields.

2、Growth: The fund seeks companies with high revenue growth rates, high earnings growth rates, and increasing profitability.

3、Momentum: The fund favors stocks with high price momentum, indicating upward trends in stock prices.

4、Risk: The fund evaluates companies' financial health, management quality, and industry trends to minimize potential risks.

Key Characteristics

1、Diversified portfolio: The fund invests in a diversified portfolio of stocks across various sectors and industries.

2、Quantitative approach: The fund uses a systematic and disciplined investment approach to minimize emotional biases.

3、Risk management: The fund has a risk management system in place to monitor and control potential risks.

Fees and Expenses

The fees and expenses associated with 博时智选量化多因子股票C include:

1、Management fee: 0.80% per annum

2、Custodian fee: 0.20% per annum

3、Other expenses: Other expenses, such as administrative and operational costs, are also charged.

Historical Performance

The historical performance of 博时智选量化多因子股票C can be evaluated by looking at its past returns, volatility, and Sharpe ratio、However, it's essential to note that past performance is not a guarantee of future results.

Investor Suitability

博时智选量化多因子股票C is suitable for investors who:

1、Seek long-term capital appreciation

2、Are willing to take on moderate to high risk

3、Have a time horizon of at least 5 years

Investment Risks

As with any investment, there are risks associated with 博时智选量化多因子股票C, including:

1、Market risk: The fund's value may fluctuate due to market conditions.

2、Stock selection risk: The fund's performance may be impacted by the selection of individual stocks.

3、Quantitative model risk: The fund's quantitative model may not always accurately predict stock performance.

Conclusion

博时智选量化多因子股票C is a Chinese stock mutual fund that uses a quantitative multi-factor approach to select stocks、The fund aims to provide long-term capital appreciation and is suitable for investors seeking exposure to the Chinese stock market with a moderate to high risk tolerance、However, it's essential for investors to carefully evaluate their investment goals, risk tolerance, and time horizon before investing in this fund or any other investment product.

0

IP地址: 209.196.102.175

搜索次数: 98

提问时间: 2025-04-16 23:15:07

❓️ 热门提问:

域名注册商查询工具

铂金戒指戴在哪个手上

北京回收黄金饰品

黄金买什么牌子靠谱

黄金手镯au916

智能ai识图

黄金买卖多少钱一克?

中国推广

外汇总额

俄罗斯有多少外汇储备

豌豆Ai站群搜索引擎系统

🤝 关于我们:

三乐Ai

作文批改

英语分析

在线翻译

拍照识图

Ai提问

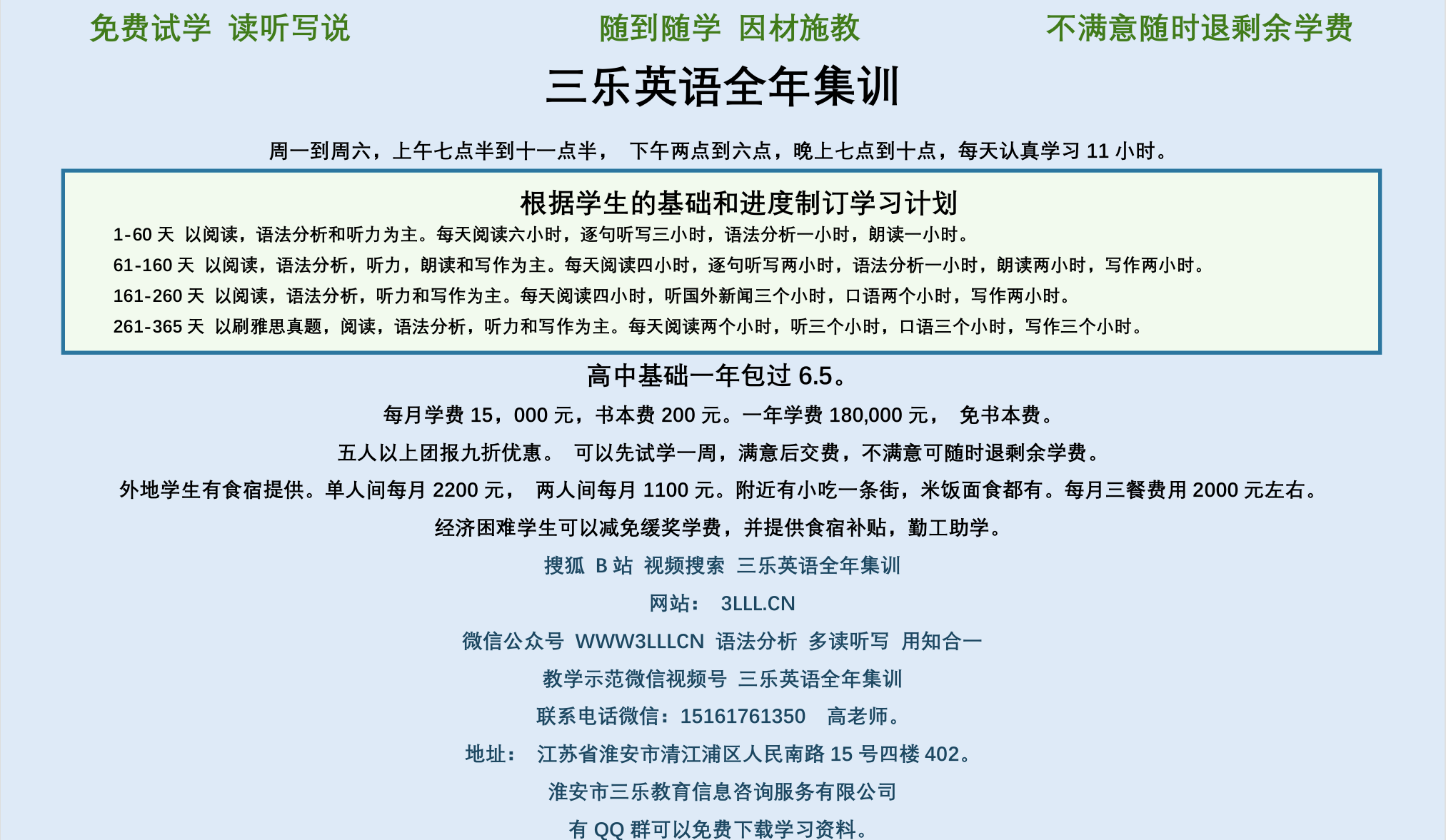

英语培训

本站流量

联系我们

📢 温馨提示:本站所有问答由Ai自动创作,内容仅供参考,若有误差请用“联系”里面信息通知我们人工修改或删除。

👉 技术支持:本站由豌豆Ai提供技术支持,使用的最新版:《豌豆Ai站群搜索引擎系统 V.25.05.20》搭建本站。